How to create successful products and services by using conjoint analysis?

Successful businesses know what their customers want (and need) and subsequently act on this. Finding out what your customers exactly want, however, can be quite challenging. Studies into the success vs. failure rates of new products generally show that 75% to 95% of newly introduced products fail, underlining the importance of knowing your customers’ needs.

One of the most powerful research tools for identifying these needs is Conjoint Analysis (CA). This method provides the required customer insights before huge amounts of money and time are committed to the (new) product/service. Incorporating CA within decision-making can therefore provide a strategic advantage. For many companies it is a must-have tool for a variety of dynamic business questions.

What is conjoint analysis?

Conjoint analysis is a quantitative research method that enables you to determine the preference and importance that customers place on various product attributes and features. It helps to understand how customers make (purchase) decisions. The underlying principle of CA is that any product can be broken down into multiple attributes that impact users’ perceived value. It is a statistical analysis that helps uncovering and understanding trade-offs customers would make by forcing them to choose out of several alternatives of product options/configurations. Central in the analysis is the idea that attributes can increase or decrease the likelihood of an overall product offering being purchased; meaning preferences can be quantified.

With the acquired insights, businesses can respond to the precise wants of customers by optimizing their product(s) and its elements. This results in a win-win situation for both the business and their customer.

How does conjoint analysis work?

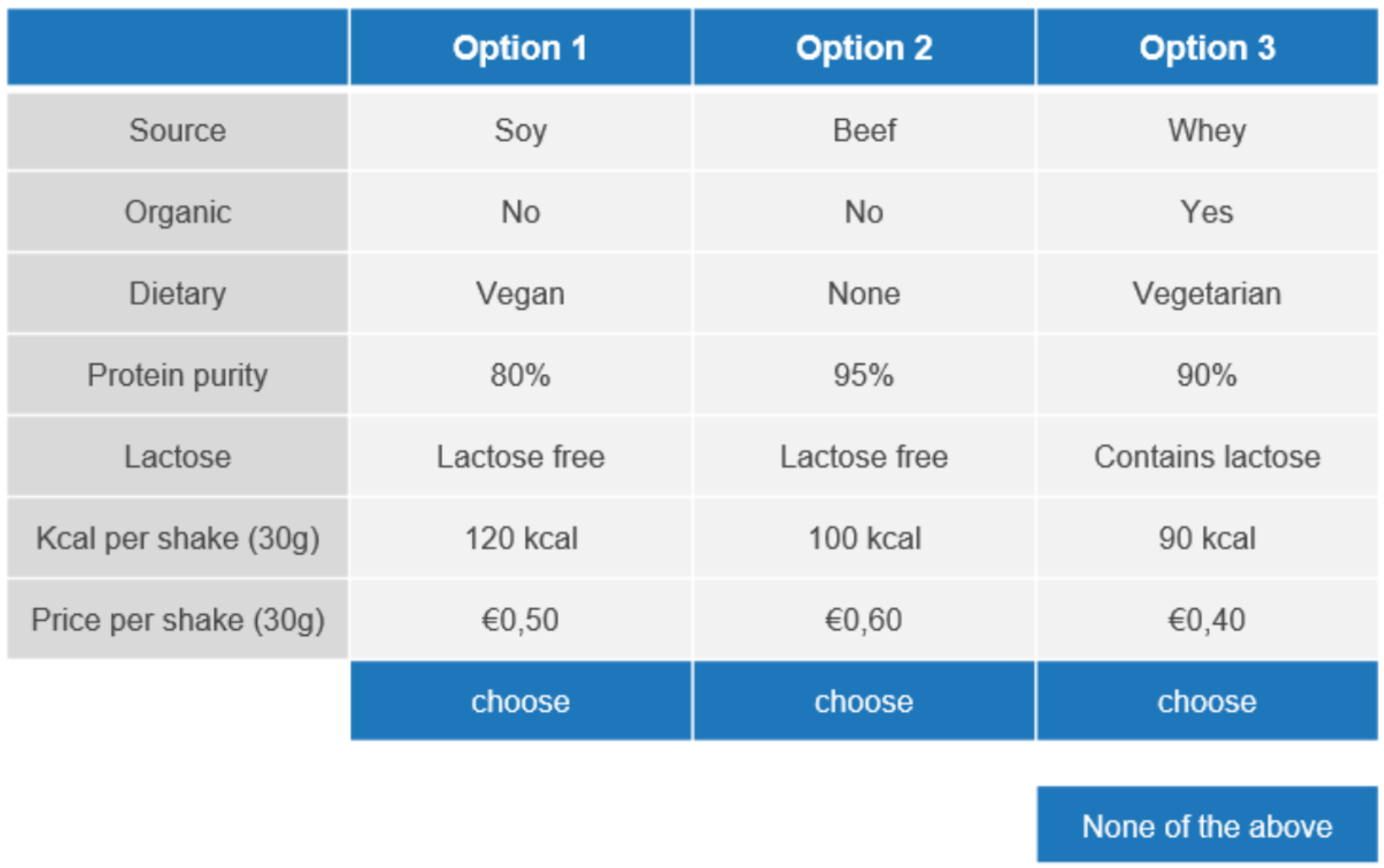

CA is conducted by presenting varying product configurations (also referred to as options, bundles, etc.) as alternatives. Participants are given instructions to evaluate the product configurations and select the one they are most likely to purchase or what is most appealing. In each question, respondents must choose one of the alternatives presented to them. Usually the number of alternatives per question is two to four. There is also the option to include the option ‘none’ as an alternative. This way it is not only measured which of the product offerings is most likely to be purchased, but also whether customers would actually buy it. Respondents are shown a series of choice sets and make trade-offs while proceeding through the questionnaire. The selected alternatives give insight in which attributes/features and combinations between them are most frequently chosen. And vice versa, which configurations are less attractive to customers.

Steps in running a CA:

- Determine the attributes and levels

- Create experimental design

- Data collection

- Analysis

- Reporting

There are different types of CA, each having its own specific application. However, the above mentioned general steps are central in all CA types. The most common types are the choice-based conjoint analysis (CBC) and adaptive conjoint analysis.

Application areas of conjoint analysis

Arguably the most researched topic in CA is price elasticity/sensitivity. When pricing is the central topic, businesses can use CA to optimize market share, profit, revenue, and to find pricing sweet spots. The insights learn businesses whether there are untapped potentials to be unlocked. However, pricing policy isn’t the only application area of CA.

Moreover, CA can be of value to any business department, answering a wide variety of business-related questions.

Some examples to illustrate:

Optimal pricing policy

- How can we create premium and paid versions based on customers’ valuation of the offerings?

- How do customers value (either relative/monetary) offerings and their separate features/attributes? How much are customers willing to pay for a premium feature?

- What role plays price in customer decision making?

- Are customers price sensitive and what are pricing sweet spots?

- Which product configuration should we offer to maximize revenue? And profit?

(New) product development & design

- Which specific features should be prioritized in R&D?

- Which attribute is most influential in customers’ decision making?

- How can we design ideal offerings?

Marketing/advertising strategies

- What marketing messages lead to the highest customer activation?

Packaging

- Which packaging design is most appealing?

- Does packaging impact willingness to purchase?

Competitive landscape & shares

- How does our offering compare to competitor’s offerings in terms of market shares? How does shifting in product configuration affect our market share?

- What product characteristics are most valued in the market and should we do to compete best against current offerings on the market?

- Which product configuration should we offer to maximize our customer base?

Repositioning existing products

- What are the best improvements we can make to our current products?

- Is a price increase justified (and profitable) by adding a new functionality to our product/service?

Running market simulations

To answer any of the above questions, thorough analysis of the collected data is key. A very effective way to do this is by using market simulations.

In a market simulator, various product configurations based on combinations of attributes and differing levels can be created in numerous scenario’s (or forecasts). This allows for running sensitivity analyses, examining customer shifting behavior, assessing which features are essential in decision making, and testing alternative strategies/options. Businesses get answers to any ‘what if’ questions they have, based on which they can improve and optimize f.i. their products, pricing, profit/revenue and customer base. In these simulations, preference data (utilities) from respondents are used to compute the percentage of respondents preferring each product in a given scenario. Simulations can be done for the total group of respondents, but also for specific segments (e.g. based on demographic data like country or age). This results in more precise insights per customer segment and provides opportunity to customize product offerings per segment.

Conjoint analysis is an essential addition to your MI toolbox!

To conclude, conjoint analysis is a highly efficient and effective tool for uncovering customers’ preferences. After determining attributes and translating them into the research design, which is a crucial part of setting up the CA, respondents choose their preferred alternative from a number of choice sets. The acquired insights can be used in a wide spectrum of (business) departments and industries by providing vision into many objectives. It is a unique methodology specializing in answering questions that other research methodologies cannot.

Curious how CA can help optimizing your business? Get in touch via +31 85 333 2472 or info@hammer-intel.com.

This article is written by Jasper Reintjens

Recent blog posts

Supporting HealthyProteins in shaping strategic focus for growth

How Data Science is Revolutionizing Market Intelligence | 6 Game-Changing Uses